Stop Chairman Wheeler from Approving Disastrous Charter Deal

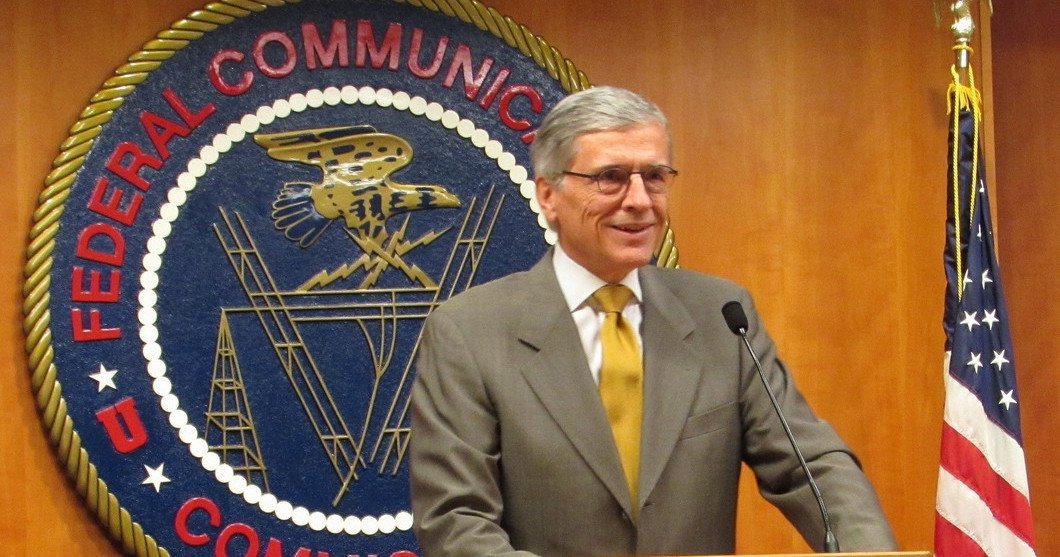

Original photo by Flickr user Federal Communications Commission

Late last night the Wall Street Journal reported that FCC Chairman Tom Wheeler is moving toward approving Charter’s $90-billion takeover of Time Warner Cable and Bright House Networks.

He’ll still need to put the deal to a vote — which means there’s time to influence the outcome if you act fast.

Here are the reasons you should pick up the phone and tell the FCC to block the merger:

Steep prices would go through the roof, forcing families around the country to make hard choices about basic necessities.

Charter is taking on huge debt just to make this deal happen. The additional burden works out to about $1,142 for the average customer, just in new debt. It would saddle the post-merger Charter with an incredible $66 billion in debt, including $27 billion created just to close this deal.

To repay that, and to satisfy its investors, Charter would have to raise its prices substantially — squeezing captive customers and forcing some offline.

To make matters worse, Charter’s entry-level broadband prices are already much higher than Time Warner Cable’s entry-level $15 tier. The closest thing that Charter has to this price is a higher-speed package that starts at $40 per month as a promotional rate, then increases to $50 per month in year two, and to $60 after year two.

And this merger means higher prices for everyone: Charter’s expanded market power would lead to price hikes on top of these already steep rates.

Price increases would hit low-income people the hardest, including those in communities of color who are on the wrong side of the digital divide and who make up a large percentage of the population in places like New York City, Los Angeles and other big cities these cable companies serve.

These price increases would make getting online impossible for way too many people.

In a world where internet access is essential, that’s unconscionable. A recent Pew Research Center report found that home broadband-adoption rates dropped from 70 percent of U.S. adults in 2013 to 67 percent in 2015.

The numbers are even more dismal for communities of color: Adoption plummeted from 62 percent to 54 percent for Black households and from 56 percent to 50 percent for Latinx homes. Pew found that price was the primary reason for this decline.

Broadband is too expensive yet it’s undeniable that people need it. If this merger goes through, more people would be forced to the wrong side of the digital divide. This chasm affects people’s day-to-day lives and increases inequity in a society in which every gap between the haves and have-nots is growing wider.

Together Charter and Comcast would have unprecedented control over our cable and internet connections, erasing competition and choice for most homes in the country.

If the merger goes through, just two internet service providers, Charter and Comcast, would control nearly two-thirds of the nation’s high-speed internet subscribers.

In 90 percent of its expanded territory, Charter would face no fiber-to-the-home broadband competition from companies like Verizon FiOS or Google Fiber. In more than half of Charter’s territory, Charter customers would have no other option at all for bundled broadband and video services. That means Charter would have unfettered ability to increase prices in its broadband monopoly territories.

This lack of competition and choice would leave homes across the country at the mercy of two cable companies known for high prices and terrible customer service.

Charter would rather burn money to pay for this deal than help more people get online at affordable rates.

For the amount of new debt Charter is taking on to close this deal, it could literally rebuild the entire Time Warner Cable network from the ground up with money to spare. Better yet, it could bring future-proof fiber-optic broadband to 40 million new homes.

Put another way, for the amount of new debt that Charter is taking on for this transaction, it could cover an area three times larger than its existing footprint, and 1.25 times as large as Time Warner Cable’s. Building new networks in more cities would increase competition and lower prices so that families with kids, people looking for work, and others struggling to make ends meet could get online.

But this $27 billion in new debt — taken out of captive Charter customers’ wallets — isn’t going to be used to build anything; it’s merely a payoff to Time Warner Cable’s shareholders and its CEO Rob Marcus, who gets a $100 million golden parachute as his reward.

The FCC says it wants competition — and key leaders have spoken out about the need for more choices — so why would the agency approve this takeover?

In 2014, FCC Chairman Tom Wheeler said, “meaningful competition for high-speed wired broadband is lacking and Americans need more competitive choices for faster and better internet connections.”

In 2016, Wheeler admitted that he “has not done enough” to encourage competition between cable giants. Moreover, President Obama has noted that “In too many places across America, some big companies are doing everything they can to keep out competitors.”

There is no real support from Congress for this merger — and senators from both parties, including Senate Democratic Leader Harry Reid, are speaking out against it.

This deal is all about Charter controlling and cutting off your online video options to protect its pay-TV cash cow.

People are tired of paying for cable. They want and need their broadband access, with all of the opportunities and choices the internet brings them. But millions of people have cut the cord on cable TV, giving up bloated lineups full of channels they don’t watch and don’t want to pay for anymore.

This makes cable companies like Charter angry. And when they get angry, they have ways to make you pay.

Don’t listen to Charter’s promises that it won’t violate some of the Net Neutrality rules or stick you with data caps — for now. Charter would have all kinds of tools to keep you paying for its own cable TV and online video packages, making it harder for you to switch and watch Netflix, Amazon and all the other online video options that are out there.

No conditions can mitigate this deal’s many harms. It isn’t in the public interest.

Despite Charter’s promises that it’ll improve diverse programming and offer low-cost broadband to some families, such merger conditions have historically been difficult to implement and impossible to enforce. Even if they were enforceable, these limited commitments would fail to off-set this merger’s serious harms.

And none of these benefits depend on this merger. Charter pretends it can offer good service and obey the law only if it gets the merger, but that’s simply not true. In short, no conditions can make this deal OK.

Monopoly power is crushing people: It means fewer choices, higher prices, no accountability and no competition.That’s why we’re fighting this deal.

We’re fighting because we need an internet that’s open, affordable and competitive. We need a platform that supports independent journalism; provides space for everyone to speak, listen and share; and puts people at the center instead of big corporations.

Time and time again hated companies like Charter and Comcast have proven that they can’t be trusted — and they have every incentive to clamp down on our digital future. All these big companies care about is their bottom line — they don’t care about regular people who depend on the internet.

Free Press and our allies have already delivered more than 300,000 petitions to the FCC, and thousands of people have bombarded the commissioners with phone calls. We’ve made formal legal filings at the FCC opposing the merger, we’ve met with members of Congress — and senators from both parties are speaking out.

The case against this terrible merger is clear. It should be blocked, plain and simple. But if these news reports are true, that’s not what Chairman Wheeler is getting ready to do.