The T-Mobile/Sprint Merger Is Bad News. Here's Why.

When T-Mobile and Sprint announced their intent to merge, we said that approval of that deal would mean higher prices, fewer jobs and more privacy invasions.

These two companies are spinning hard to claim that this horizontal merger — that is, a deal eliminating a competitor in an already concentrated market — will magically lead to more choices, more innovation and even more investment and jobs. Some press reports took the bait and reprinted that merger propaganda without questioning it.

In reality, each of those claims is nonsense. Here’s why the T-Mobile/Sprint proposal is bad news for people of color and all communities and constituencies that rely on having more affordable and open wireless options.

The merger would raise prices for people working hard to afford communications services

The digital divide is an ongoing problem that threatens the well-being of low-income communities and communities of color. That gap has shifted over time, but it’s never closed.

As some people adopt newer technologies, the older technologies become more ubiquitous and more affordable as they become less cutting-edge. That kind of progress isn’t acceptable so long as a gap remains, but at least there’s been some measure of improvement across the population.

However big the gap between digital haves and have-nots is today, it would be much wider if not for the mobile broadband market.

As Free Press wrote in our 2016 report Digital Denied, “despite the persistence of a digital divide for wired internet-access connections, the relatively higher levels of competition and choice in the mobile market have largely closed such divides in mobile internet and cellphone adoption.”

That higher degree of competition has helped create robust mobile broadband markets for resellers — companies that don’t have their own networks, but buy wholesale access from the big wireless carriers and resell it at a lower price.

These independent resellers, and even the big-four wireless carriers (Verizon, AT&T, T-Mobile and Sprint, under brand names like Cricket, MetroPCS and Boost) also offer prepaid services. Prepaid carriers charge more affordable prices, and just as importantly they typically don’t require a credit check first from potential customers.

Credit checks can be a barrier to broadband adoption that discriminates against people of color, who often have lower credit scores than White customers even at the exact same income level due to structural and systemic biases in the credit system and financial industry. All such barriers prevent people on the wrong side of the digital divide from having the opportunity to adopt certain broadband services, including the more expensive “post-paid” wireless and wired services from companies that do require credit checks first.

There are robust resale and prepaid markets for mobile broadband, but they never developed for wired home broadband. Why? Because wired home internet is an uncompetitive duopoly.

That’s not the case in wireless.

There are now four national wireless carriers (and a decade ago there were six). Historically, T-Mobile and Sprint have had fewer customers and fewer advantages than their larger rivals AT&T and Verizon: giant companies descended from the old monopoly Bell system, but now with both wired and wireless networks.

This doesn’t mean that T-Mobile and Sprint are uncompetitive or unimportant. Just the opposite. Those two carriers still have a nationwide footprint, and they’re motivated to recover their investments in their networks not only by selling directly to customers but by selling capacity to resellers (also referred to in the industry as Mobile Virtual Network Operators, or “MVNOs”). T-Mobile and Sprint also have had more incentives to offer their own more affordable prepaid options.

By contrast, AT&T and Verizon each control about a third of the market, and in this position of market dominance have found that ignoring the needs of low-income and credit-challenged communities maximizes their profits. AT&T and Verizon have generally avoided wholesaling capacity to resellers, and have also neglected or scaled back offerings of their own lower-priced prepaid services.

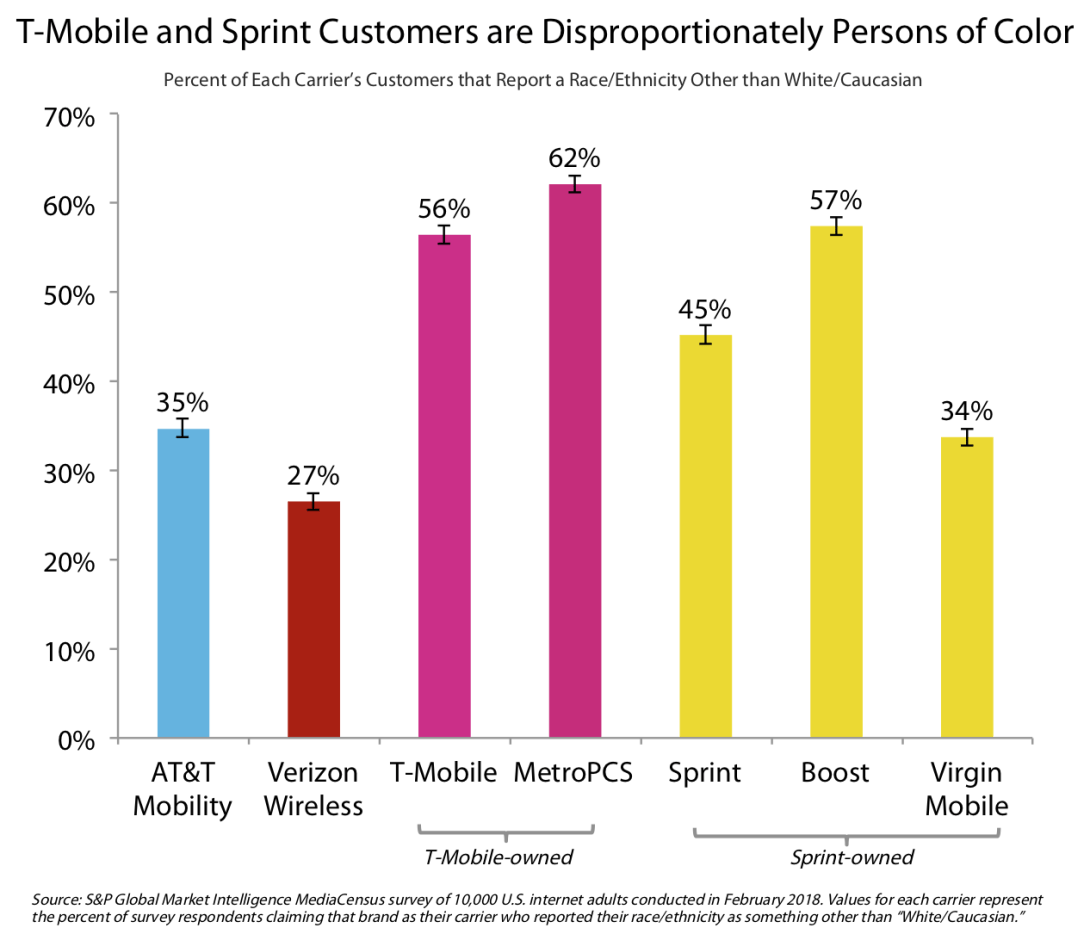

That reality is borne out in the subscriber numbers and customer bases for all of the largest wireless carriers. People of color, and people with lower incomes more generally, disproportionately choose T-Mobile and Sprint brands instead of AT&T and Verizon.

According to a recent survey from S&P Global Market Intelligence, 56 percent of T-Mobile’s customers are people of color, as are 45 percent of Sprint’s customers. (That number is even higher for some of these carriers’ prepaid brands: A whopping 62 percent of MetroPCS customers and 57 percent of Boost customers are people of color.)

Contrast those numbers with AT&T’s and Verizon’s much lower percentages (35 percent and 27 percent, respectively) of people of color as customers, and the merger’s direct harmful impacts on price and affordability become crystal clear.

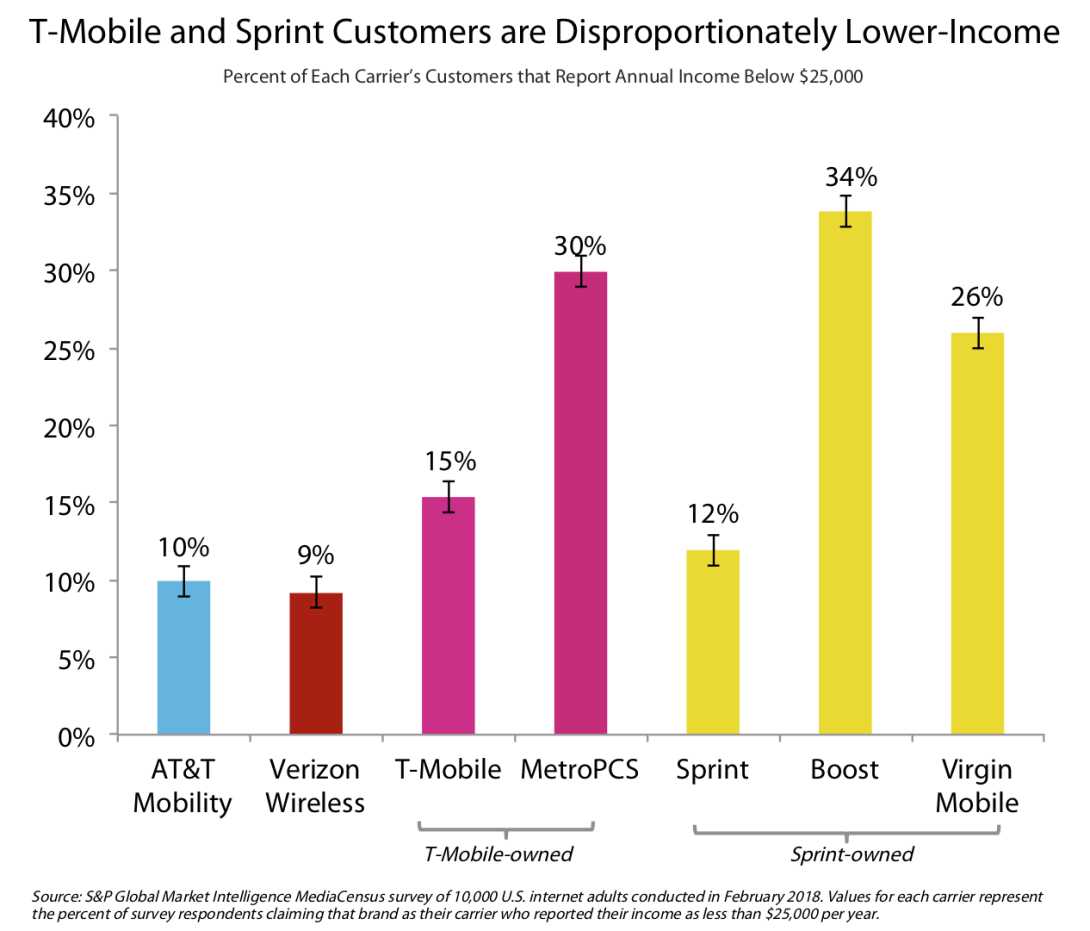

And while the gaps between the carriers’ percentages of customers with incomes below $25,000 per year aren’t as large, they’re still significant. Just about 10 percent of AT&T and Verizon Wireless customers fall into that income bracket, while 15 percent of T-Mobile customers and 12 percent of Sprint customers do.

With the more affordable and no-credit-check prepaid brands in the mix, those numbers skyrocket. Nearly 30 percent of MetroPCS customers and 34 percent of Boost customers have incomes below $25,000.

Were it not for the existence of T-Mobile and Sprint as independent competitors to the wireless market’s “Twin Bell” giants at AT&T and Verizon, the digital divide would be much worse, and people in low-income communities and communities of color would be even more unconnected than they currently are.

The merger would mean more invasive marketing and corporate surveillance

This merger wouldn’t just threaten affordability and adoption. It would also undermine our broader freedoms to connect and communicate.

With FCC Chairman Ajit Pai’s radical reversal of the Obama-era FCC’s strong Net Neutrality rules and legal underpinning, we no longer have protections in place that guarantee our rights to send and receive the digital information of our choosing without undue interference and discrimination from ISPs.

Every day a stream of headlines rushes past, reminding us of how our ability to communicate freely is under assault from the forces of the hyper-commercialized internet system.

It doesn’t have to be that way, of course. There are smart people out there working on new communications protocols that would enable the creation of the “next internet,” one that’s noncommercial, peer-to-peer and more protected from the prying eyes of advertisers, carriers, and platforms like Facebook chasing the pot of “surveillance capitalism” gold.

But without affordable, robust, wide-open pipes — the wired- and wireless-access networks that carry our data — any dream of a newer and better internet will die in its infancy.

We’re already seeing AT&T and Verizon charging full-speed ahead to use their newfound, Trump FCC-granted abilities to spy on our every click. These carriers want their cut of the surveillance-capitalism economy. AT&T and Verizon also have massive wired networks, adding to their pervasiveness and their power.

Other major wired providers like Comcast and Charter are also salivating at this prospect. And they’re all racing to acquire content providers to gain even more insight into and control over their users’ choices and online experiences. (See AT&T’s attempted takeover of Time Warner’s lucrative portfolio that includes HBO and CNN, among other marquee names.)

If T-Mobile and Sprint are allowed to merge, this reduction in competition means it would be unlikely for either of these companies to follow T-Mobile’s self-described “Uncarrier” marketing strategy. In this case, that could mean giving up on positioning itself as a privacy-protecting telecom alternative.

Indeed, T-Mobile and Sprint are claiming that this deal will generate enough additional profits to let the newly merged colossus get into the “rapidly converging content and communications marketplace” — just like the rest of the big wired and wireless providers.

So this merger isn’t simply about the two companies at the center. A more concentrated marketplace would also give more market power to the companies at the top: AT&T and Verizon.

At a time when the Trump administration and many Republicans in Congress have given the green light for ISPs to spy on us, the last thing we need is a merger that would give more market power to AT&T and Verizon, which are eager to use their content portfolios and knowledge of our every click to grab even more surveillance-economy cash.

The merger would lead to thousands of job losses

T-Mobile and Sprint are spinning the yarn that this deal would create jobs, lead to better 5G wireless-network deployment — and keep prices stable.

That’s the tale told to politicians and regulators. The truth told to the investor community is that this deal would be good for Wall Street, not Main Street. It would result in tens of thousands of lost jobs, mostly from the ranks of lower-paying retail positions.

It would give massive pricing power to the remaining “Big Three” carriers (AT&T, Verizon and the new T-Mobile), whose investors are eager to see an end to the so-called wireless price wars that resulted after the government rejected the AT&T takeover of T-Mobile in 2011.

And as has always been the case, T-Mobile and Sprint in their own rights would individually still deploy robust 5G networks if the government blocked their merger.

In fact, the deployment plans for each company are already in place. Both carriers have told their investors that they would build and upgrade these new networks.

This last point is a critical one.

The carriers’ lobbyists and industry observers have told those of us who have complained about the state of duopoly competition in the home-internet market that wireless competition is going to solve that problem.

It wasn’t true of 3G, the wireless networks that were then the cutting-edge technology until about a decade ago, and it’s not true of 4G today. But the capacities of 5G may finally bring a modicum of competition to the wired home-internet market.

However, that competition isn’t going to start with AT&T or Verizon. Those companies have no desire to cannibalize their profitable wired offerings. They want you choosing (and paying for) both services, and the prospect of more competition scares them.

But the existence of an independent T-Mobile and Sprint, with different motivations and business plans, provides at least some hope that maybe one or both of them would figure out how to make wireless a true competitor to wired home broadband.

Indeed, Sprint showed a willingness to take a risk on this with its purchase of the fixed wireless company Clearwire more than a decade ago.

Even more likely, preserving T-Mobile and Sprint as independent 5G competitors could spur AT&T and Verizon to move in this direction instead — just as competitive pressures from T-Mobile and Sprint spurred the Twin Bells to return to uncapped data plans.

But if we instead concentrate the market, it decreases the incentives for any of these wireless companies to innovate and risk entering the home-internet market with a 5G product. The post-merger T-Mobile would instead chase the higher-margin, post-paid affluent wireless market that AT&T and Verizon focus on, rather than trying to compete with Comcast or Charter on the cable companies’ turf.

There’s much more to say about why this deal is such a bad one for Internet users and families who are already struggling to stay connected. But it’s clear at the outset that the pro-merger propaganda we’re hearing from T-Mobile and Sprint is the same rhetoric we’ve heard in deals past.

It was wrong then, and it’s really wrong now.