Comcast-Fox Bid: Latest in a Media-Merger Mania that Stifles Competition, Threatens Net Neutrality and Harms Consumers

WASHINGTON — Comcast has offered $65 billion in cash to acquire 21st Century Fox, the television, film and entertainment colossus that Walt Disney Co. is also seeking to acquire.

If successful, the $80-billion merger ($65 billion in cash, plus Fox’s $15 billion in debt) would add considerable content properties to a company that already owns NBC Universal. Yesterday’s court decision approving AT&T’s acquisition of Time Warner is reported to have been the trigger for Comcast’s announcement today.

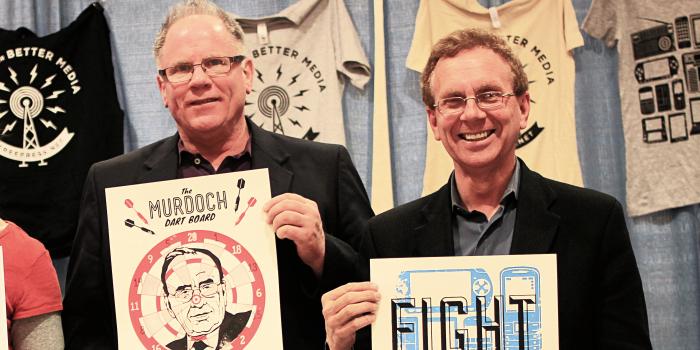

Free Press Research Director S. Derek Turner made the following statement:

“Comcast thinks the time is ripe for deal-making, but the public will quickly sour on this proposal. We simply don't need the country's biggest cable company and broadband provider controlling even more content and taking even more of our money every month.

“This merger will further strengthen Comcast’s hand, making it far more difficult for rivals to compete. And now that Comcast is free from all federal Net Neutrality obligations, there is literally nothing stopping it from using this power to favor its own online content and services over others, taking choice away from internet users and creating an internet that closely resembles cable TV. It’s dangerous to have too much media content under the same roof as a nationwide video-distribution platform like Comcast.

“Comcast thinks the AT&T deal should give them the green light here for more expansion. But, as AT&T’s top lawyer said after yesterday’s verdict, each merger should be evaluated on its own, and the specific facts matter.

“The Comcast-Fox deal is also a vertical deal, but very different from AT&T. Comcast is already a major studio owner and content owner, and will grow much more with this deal. Further, Comcast already holds a stake in Hulu and will become the majority owner if this deal is approved. This is a competition killer.

“If approved, the 21st Century Fox takeover would saddle Comcast with a whopping debt load. There’s every reason to believe that internet and pay-TV rate hikes would follow this deal, as Comcast exploits its dominant position to gouge its competitors and customers alike.

“It’s time we started to talk about what a rip-off mega-deals like AT&T-Time Warner and Comcast-Fox are. For the price of these two completely self-serving deals, which will only benefit the uber-wealthy shareholders, we could deploy fiber optic broadband to every U.S. home. Instead, we get higher bills, lousy service and fewer choices. What a waste.”