Unjust Data Caps Are Driven by Greed and Undermine Efforts to Close the Digital Divide

Cable One — a broadband provider to 923,000 customers in 24 states — made some honest comments that should make regulators at the Federal Communications Commission sit up and take notice.

In the company’s second-quarter conference call, CEO Julia Laulis gave some specific data on Cable One’s experience with the Emergency Broadband Benefit program (EBB) created by Congress last December and implemented by the FCC this spring.

The EBB is a temporary $3.2-billion broadband-subsidy program for low-income households passed as a part of pandemic-relief legislation in late 2020. Households that qualify sign up with a participating ISP, which then applies an EBB discount of up to $50 off the customer’s monthly subscription price. (The bipartisan infrastructure legislation working its way through Congress would make this temporary relief more permanent by increasing the budget to $14.2 billion, setting the subsidy at $30 per month and adding more consumer protections).

Cable One’s CEO noted that the company had enrolled 5,000 EBB customers, which amounts to about half of one percent of the company’s total residential broadband-customer base. These data may be another sign that initial EBB participation is low (or that Cable One’s services are too expensive, even with the discount), though it is way too early to draw any firm conclusions about participation rates in a program that’s less than three months old.

Laulis also reported that more than 90 percent of Cable One’s EBB participants came from its existing subscriber roll — fewer than 10 percent were new customers. This alone isn’t a definitive indicator of anything, other than that perhaps the company’s EBB outreach is far more effective at reaching existing customers than it is at finding people who are using a different ISP or who were non-adopters till now.

What really stood out in Laulis’ presentation is Cable One’s disclosure that more than 75 percent of these EBB customers declined the ISP’s $39 promotional-rate package (which goes to $55 as the standard rate after six months).

That entry-level 100 megabits per second (Mbps) plan is something value-conscious new customers might be expected to choose, or a plan that all of those existing Cable One subscribers qualifying for the EBB might be expected to stay on. Instead the bulk of them are choosing packages offering 200 Mbps or higher, priced from $65 to $125 per month before fees. The CEO also clarified that these EBB participants are upgrading at three times the rate of a non-EBB customer.

A pure cash grab

It is very notable that the overwhelming majority of Cable One’s EBB customers are dropping their current plans — which would cost them no more than $5 even if they were paying the $55 standard rate for it, and could be completely covered by the EBB at the $39 promotional-rate level. Instead of choosing or staying with the 100 Mbps tier, they’re paying more out of pocket and upgrading at three times the rate of Cable One’s overall subscriber base.

It may seem at first glance that these EBB customers are simply willing to forego a relatively lower bill in exchange for faster transmission speeds, and that’s what the EBB is supposed to allow for — giving people more choices about what they can afford. Yet I think there are other factors driving this disproportionate result.

As you can see in the above screenshot, Cable One imposes extremely low data caps, and charges huge fees if a customer exceeds those limits. Not only are these data caps onerous and small, they are seemingly designed that way to push customers to more expensive tiers, with speeds that the customer may have no use for but must choose to be able to use their connection without fear of a surprise bill for going over the cap.

The entry-level tier’s monthly cap of 350 gigabytes (GB) is more than 25 percent below the company’s average customer use of 475 GB per month, and that monthly data-usage value is commensurate with the national average. But Cable One isn’t just setting the entry-level tier’s cap low — the next tier up comes with a 700GB limit itself, which is above the average use but still well below the industry standard.

Indeed, Cable One is an outlier among its peers in imposing such low and punitive data caps. Comcast and Cox impose 1,200 GB and 1,250 GB limits respectively. AT&T’s cap is 1,000 GB on most of its plans, and it recently dropped them completely for all tiers above a speed of 75 Mbps. Many other ISPs like Charter, Lumen, Optimum and Verizon have either never imposed caps or recently dropped them for all customers.

Even the relatively higher caps imposed by ISPs like Comcast and AT&T are concerning, as the average use value continues to rise in the streaming-media era, with an accelerating number of broadband users using more than 1,000 GB per month as more people replace traditional cable-TV with streaming services.

So let’s be clear: Wired-broadband data caps and overage fees are pure cash grabs. Yet Cable One’s caps still stand out for being completely unjust and unreasonable. There’s simply no legitimate engineering or economic justification for this, except for greed.

And the company’s EBB enrollment data suggest that lower-income customers have borne the brunt of Cable One’s data-cap greed. They’re likely upgrading at three times the rate of non-EBB customers because they now have the opportunity to enjoy their connection at the average level of monthly data usage without having to hand over their limited funds to pay overage fees and line Cable One’s pockets.

Empty network, fat profits

Cable One’s CEO made it clear that its extremely low data caps have no basis in the industry’s usual tropes of “network management” or “fairness.”

Laulis told analysts that “[p]lant utilization during peak now averages below 20 percent for both downstream and upstream traffic. Downstream improved meaningfully year-over-year from 25 percent to 19 percent and upstream utilization grew slightly from 17 percent to 18 percent. As a result of our ongoing investment and upgrades targeted at expanding capacity, we continue to stay well ahead of the demand curve.”

Translation: Cable One’s network has massive headroom and no congestion issues, despite slightly bumping up its caps last year; and that’s because of the efficiencies offered by the current generation of cable-modem technology. Don’t make too much of the line about “ongoing investment and upgrades,” as that’s routine for any infrastructure-based company. In fact, Cable One reinvested a smaller percentage of its revenues back into the network during the past year than it did during the year before the pandemic.

Cable One’s draconian data-caps business model works quite well for the company. Its broadband customers pay far more on average than customers of other ISPs. The average Cable One customer’s monthly broadband bill was $78.34 in the second quarter of 2021, a 6.2-percent increase from a year earlier. During that same second quarter, Comcast’s broadband customers paid $65.47 per month on average while Charter’s paid $62.78.

And Cable One’s profitability is on the rise too, with an operating profit margin just under 31 percent during the pandemic, up from 28 percent during 2019.

Help on the way?

As noted above, Congress is on the verge of extending and updating the EBB, which will be known as the Affordable Connectivity Program (ACP). The EBB, while much needed, was done in a rush and on an emergency basis. The FCC stood it up with fewer guardrails that would protect participants from certain types of mistreatment from their ISPs. The legislation creating the ACP fortunately has language that empowers the FCC to protect these vulnerable users.

Under the ACP, the FCC would craft rules that protect participants from “inappropriate upselling,” a common industry practice, but one that is particularly harmful to those with lower incomes. Upselling generally involves goading a customer into purchasing a more expensive package than they would otherwise buy. And in the ISP industry, it sometimes involves a customer representative claiming that moving to a higher tier will solve a customer’s service-quality issues, when those issues are most likely to be caused by a poor Wi-Fi signal.

Cable One may be upselling its EBB customers into higher tiers to make more money, and it may have such success doing so because its less expensive tiers come with comically low data caps. So it is encouraging to see that under the ACP, the FCC would be empowered to act against “similar restrictions that amount to unjust and unreasonable acts or practices that undermine the purpose, intent, or integrity of the Affordable Connectivity Program.” This language, which mirrors the language at the core of Title II of the Communications Act, is the bedrock of all telecommunications consumer protection — protection that is especially warranted in a market for an essential service where there’s minimal competition.

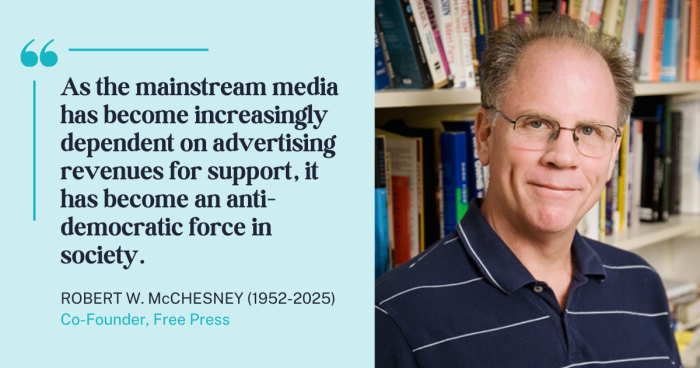

What the FCC does with this authority remains to be seen (of course, assuming the ACP as constructed becomes law, something that is expected but not a certainty). But Free Press will continue to shine a light on ISPs’ use of data caps and other unjust and unreasonable practices, even if and when the FCC moves at last to do something about them.

For the first time in a long time there’s reason to be hopeful that the agency (once fully staffed) will act to ensure people with low incomes and other broadband users are protected from data caps and other abusive ISP practices.